The best way to save is to reduce your expenses. Lower your expenses as much as you can.

- Aim not to spent more than 30% of your income on rent. Move into an affordable apartment/ house.

- Cut subscriptions that you are not fully utilising. Every cent counts.

Budgeting and saving goes hand in hand.

- Budget

Before you receive your salary which you already know how much it is or have an idea of how much it’s going to be.

1st month

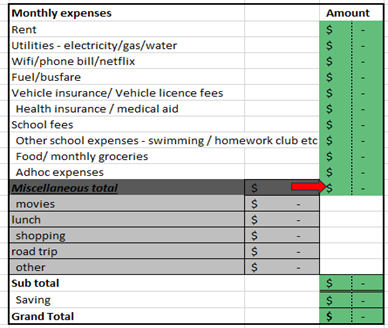

- Make a list of all your monthly expenses, bills etc.

- Add the total

- If there is something left out put that in your savings account.

- Save

2nd month going forward

Now that you know what your monthly expenses were like last month and how much you saved. Repeat the same process, but this time starting with the amount you wish to save. See template below, you can create your own in excel

This template is a guideline, it’s not an exhaustive list. You can add or take away from it.

The template has a miscellaneous section as well. I put this for my lunches, movies and anything that I may wish to do in that particular month, whether Its treating myself, taking a weekend trip or anything exciting. Saving is very important but you have to live life as well. Having said that, you have financial goals. You have set a target of how much you wish to save to achieve these goals. It’s time to cut down on what is not necessary, if it’s really not necessary that month It can happen next month or quarter or next year.

- Save

- Save – pay yourself first before you pay anything else.

- You can open a separate savings account and set up an automatic savings plan to transfer money from your main account into your savings account every month.

- Limit withdrawals from your savings. You can open fixed deposit account where you can’t access the funds in your savings account for a certain period of time.

Saving can be hard but it is totally worth it long term.

Tip for the day

Live withing your means